Welcome to the Healthcare & Medical Industry Results of the SMB Internet Marketing Survey 2013.

Following the publication of the full SMB Internet Marketing Survey 2013 results, we’re now taking a closer look at specific industries to view their results and see how these compare to those we saw for all industries in the full survey.

We asked our customers & readers which industry sector they were most interested in seeing research data for. The ‘most popular’ industry was ‘healthcare & medical’ / ‘medical services’. Over 20% of the SMBs we surveyed classified themselves as working in the health & medical industry and are made up of a diverse set of specialisms including Chiropractors, Dentists, Mental health practices, medical family practices, pharmacies, psychologists, physicians, eye care specialists and many more.

About the SMB Internet Marketing Survey 2013

To recap the original survey, in October 2013 we contacted 20,000 US based businesses and asked them to participate in the survey. We received 668 responses from businesses spread across over 50 Industry Sectors. This research was conducted in partnership with ChamberOfCommerce.com and we thank them and all participating businesses for their time & assistance. Without them this survey & insights would not have been possible.

We asked 13 questions relating to their attitudes & usage of ‘Internet & Mobile’ marketing (aka ‘Digital Marketing’ as we refer to it at points in the findings below)

This survey is divided into two parts:

- The first explores the current scale of internet marketing amongst small & medium businesses, what works for them and their opinions on how this might change in the future.

- The second part explores how many SMBs use internet marketing consultants and agencies and how effective these working relationships are.

The 2013 survey is the first wave of this survey which we intend to repeat on an annual basis.

Sections & Questions

Engagement & Opinions

- 1. How much money do you allocate to marketing your business each month?

- 2. What percentage of your marketing money do you spend on internet or mobile marketing?

- 3. In the next 12 months do you plan to increase the money you spend on internet marketing?

- 4. Which of the following marketing channels are most effective at bringing you new leads & customers?

- 5. How effective is internet marketing at attracting customers to your business?

- 6. Do you have a mobile ready / mobile optimized website?

- 7. Do you think mobile & mobile marketing is important for the future of your business?

- 8. How effective is Google AdWords advertising for generating new customers?

Marketing Consultants & Agencies

- 9. Do you handle internet marketing yourself or use a freelance marketing consultant/agency?

- 10. How many times per week are you emailed/called by an internet marketing or SEO company wanting to sell you their services?

- 11. Which of these statements best applies to your attitude towards internet marketing?

- 12. If you use/were to use an internet marketing consultant which of these factors are most important to you?

- 13. Which of these statements best applies to your feelings about Google Places/Google Local?

Engagement & Opinions

Q1. How much money do you allocate to marketing your business each month?

Key Findings:

- Average marketing spend is $475 p/month

- This is 16% higher than the all-industry average

- 21% are spending more than $1,000 p/month (vs. 7% across all industries)

Analysis:

Healthcare & Medical related SMBs are spending more on their marketing budgets than similarly sized businesses from other industries. Is the healthcare marketing target market more receptive to these efforts? Or is it that there is actually more profit in the healthcare sector, enabling more substantial budgets? – certainly there are far more SMBs spending over $1k p/month (21%), than other industry sectors (7%).

Q2. What percentage of your marketing money do you spend on internet or mobile marketing?

Key Findings:

- On average 32% of marketing budget is spent on internet / mobile marketing

- The average percentage across all industries was 46%

Analysis:

Healthcare industry SMBs have larger marketing budgets overall – but far less of this is directed towards internet or mobile marketing (14% less than the all-industry average). It could be the case that offline marketing works better – certainly the average 68% offline budget would suggest that – but it could be down to other reasons.

Q3. In the next 12 months do you plan to increase the money you spend on internet marketing?

Key Findings:

- 42% have no plans to increase that spend (vs. 32% across all industries)

- 27% say yes (vs. 21% across all industries)

- 30% say maybe (vs. 47% across all industries)

Analysis:

A large 42% of healthcare industry SMBs have no plans to increase their internet marketing budget over the next 12 months. This is 10% higher than the average response from other industries. Does this show that health & medical SMBs are currently satisfied with their marketing mix?

However, in addition to this, more of them are also planning to increase their internet marketing spend than other industries – simply because most other SMBs said they were unsure of their impending plans as yet.

This suggests that medical SMBs are either more inclined, or else more able to plan ahead 12 months down the line. We know that there is a large amount of uncertainty surrounding the future of some other SMBs – but this is not as apparent in the healthcare sector. Is the health & medical industry more secure as an industry? Certainly if we look at the types of businesses involved, then it’s an industry that will always experience demand – and one that provides a necessity service as opposed to a commodity.

We also have to consider the fact that the cost per acquisition of customers in the healthcare & medical sector may be somewhat higher than other industries – meaning that more expansive internet marketing is not required in order to reach the desired revenue.

Q4. Which of the following marketing channels are most effective at bringing you new leads & customers? (select up to 3)

Online Vs Offline

Key Findings:

- 29.5% say word of mouth (vs. 26% across all industries)

- 17% say SEO (vs. 19% across all industries)

- 13% say local directories (vs. 15% across all industries)

- Offline marketing methods considered more effective (vs. 54% online across all industries)

Analysis:

Over half of all healthcare industry SMBs believe offline marketing tools are the most effective. In other sectors, online marketing was considered more effective.

Despite this, there is very little difference in the leading marketing channels that medical SMBs chose. Word of mouth marketing is considered the most effective marketing channel at driving new leads and customers. It could be said that word of mouth lends itself to the medical industry more appropriately. Certainly the industry relies on service levels as much – or even higher than others, and of course it is open to more public scrutiny, as well as being more reliant on customer reviews than other more tangible products.

Offline marketing was ultimately more favourable than the overall average, with increases in PR, local newspapers and TV advertising.

Q5. How effective is internet marketing at attracting customers to your business?

Key Findings:

- 36% say internet marketing is quite effective (vs. 41% across all industries)

- 30% say internet marketing is not effective (vs. 24% across all industries)

- 24% say internet marketing is very effective (vs. 27% across all industries)

Analysis:

Although only moderately, it shows that fewer healthcare SMBs consider internet marketing to be effective at attracting customers. This of course adds weight to the fact that medical SMBs provide less backing towards their internet marketing budgets.

Q6. Do you have a mobile ready / mobile optimized website?

Key Findings:

- 42% do have a mobile site (vs. 59% across all industries)

- 39% don’t have a mobile site (vs. 26% across all industries)

- 18% are unsure (vs. 11% across all industries)

Analysis:

The healthcare sector lacks behind SMBs from other industries when it comes to using mobile sites. 17% less have mobile sites compared to SMBs from other industries. On top of this 18% of them are unsure whether they have a mobile site or not – which perhaps suggests a lack of understanding on an industry level.

In the original survey we explored the importance of mobile & shared one stand-out stat which said that 67% of mobile users say that when they visit a mobile-friendly site, they’re more likely to buy a site’s product or service. Considering also that one quarter of all organic visits comes from mobile devices (RKG data), it seems remarkable that the 57% of SMBs from the medical sector either are unsure, or don’t currently have a mobile site.

Q7. Do you think mobile & mobile marketing is important for the future of your business?

Key Findings:

- 55% say it’s going to be an important channel (vs. 17% across all industries)

- The remaining 45% either don’t know enough about mobile & mobile marketing, or simply don’t think it’s relevant to their business

- None of those surveyed are current users of mobile marketing

Analysis:

Again we see that Medical industry SMBs are lacking behind others when it comes to mobile and mobile marketing. 27% are either unsure of it or don’t know enough about it – which is far higher than other industries. Additionally, a rather large 18% say that mobile marketing is simply not relevant to their business.

We know that mobile marketing is growing fast – so why are health and medical SMBs so slow to catch on compared to other industries?

Logically, it stands to reason that there must be plenty of mobile traffic coming from an industry sector that gets a lot of business from emergency or last minute customers. It is unlikely that all potential customers will be placed near a desktop computer at the time they require urgent medical healthcare. This is ultimately a huge opportunity for medical SMBs to pursue – any business having a well optimized mobile site in an industry that lacks behind in such a way, will certainly have an advantage over others.

Q8. How effective is Google AdWords advertising for generating new customers?

Key Findings:

- 21% say it’s very effective (same as other industries)

- 21% say they don’t use it but plan to in the future (vs. 17% across all industries)

- 21% say they don’t use it and don’t plan to in the future (vs. 15% across all industries)

- 12% say it’s ok but too expensive (vs. 25% across all industries)

Analysis:

Fewer healthcare industry SMBs consider PPC to be too expensive – which is also reflective of the fact that they have bigger marketing budgets in the first place.

However, as with the overall industry findings, a wide spread of results with no clear winner suggests some real confusion and / or differing views over the effectiveness of PPC for SMBs.

Marketing Consultants & Agencies

The second part explores how many SMBs currently use internet marketing consultants and / or SEO agencies and how effective these working relationships are.

Q9. Do you handle internet marketing yourself or use a freelance marketing consultant/agency?

Key Findings:

- 66% handle it themselves (vs. 68% across all industries)

- 15% don’t do any internet marketing (same)

- 12% use an agency (vs. 15% across all industries)

Analysis:

This is almost identical to the overall industry findings. 15% don’t do any internet marketing at all – which of course tally’s up with the low online budgets seen earlier.

Q10. How many times per week are you emailed/called by an internet marketing or SEO company wanting to sell you their services?

Key Findings:

- 27% are contacted every day (vs. 32% across all industries)

- 18% say 2-3 times a week (vs. 25% across all industries)

- 21% say they are rarely contacted (vs. 12% across all industries)

- 6% say never (vs. 2% across all industries)

Analysis:

Healthcare SMBs are contacted far less by internet marketing companies than SMBs from other industries. Are marketing agencies & consultants missing an opportunity here? Are not enough agencies experienced enough in medical marketing and healthcare marketing? – Or would any efforts prove fruitless due to the lack of belief in internet marketing as an effective tool?

Certainly we’ve seen that many medical industry SMBs are unfamiliar about the importance of mobile & mobile marketing as a tool, so perhaps it stands to reason that agencies need to educate and convince them more before selling their services.

Obviously it would make sense for internet marketing companies to contact those SMBs that have a larger marketing budget than average – even if less of that is yet to be spent online. If SEO agencies & consultants can start to convince medical SMBs about the importance of internet marketing – and particularly mobile and mobile marketing, then perhaps they can start to instigate an industry-wide change of thinking.

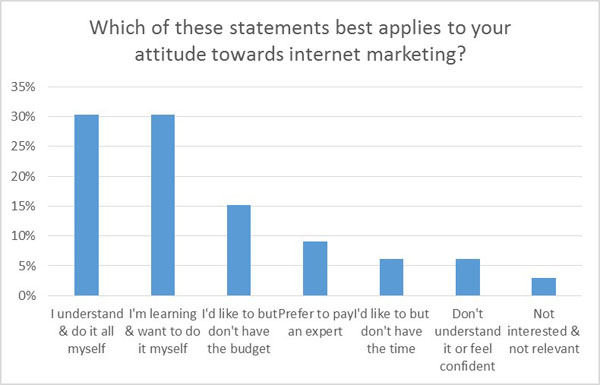

Q11. Which of these statements best applies to your attitude towards internet marketing?

Key Findings:

- 30% understand it and want to do it themselves (vs. 40% across all industries)

- 30% are learning about it and want to do it themselves (vs. 22% across all industries)

Analysis:

To put it simply, less understand how to do it, but more are learning how to do it. There are plenty of healthcare & medical SMBs that want to learn about and do internet marketing themselves but they are yet to get to the point where they feel comfortable enough to do it themselves.

It is perhaps the first sign to suggest that medical SMBs may be starting to catch-up with other SMBs on internet & mobile marketing. If nearly third of them are currently learning about internet marketing, then it is not going to be long before the industry becomes more accepting of digital as a whole – which is of course great news for agencies and consultants, who can start to try and win clients from an industry that have an above average marketing budget.

Q12. If you use/were to use an internet marketing consultant which of these factors are most important to you?

Key Findings:

- 17% say low cost (vs. 19% across all industries)

- 12% say relevant industry experience (vs. 11% across all industries)

- 11% good reputation (vs. 13% across all industries)

Analysis:

Very similar to the overall stats. The 3 most popular choices suggest that if you’re an agency and you want to successfully pitch to a medical SMB, then you need to demonstrate industry experience, a good reputation, and competitive rates. This of course goes hand in hand with the fact that agencies may need to spend more time educating or explaining their processes / benefits to a client base that has yet to fully embrace digital marketing.

Q13. Which of these statements best applies to your feelings about Google Places/Google Local?

Key Findings:

- 45.5% find it clear and easy to use (vs. 40% across all industries)

- 18% know it’s important but don’t understand it (vs. 22% across all industries)

- 12% find it frustrating because they keep changing it (vs. 14% across all industries)

- Very similar to overall stats

Analysis:

Very similar to overall stats. Is Google Local easier for medical SMBs to manage? There is a slightly more positive response to it than other industries & perhaps less confusion.

However, a relatively wide spread of answers once again underlines the overall confusion / misunderstanding of Google Local as a tool for SMBs. Once again, this represents a good opportunity for agencies & consultants, giving them the chance to pitch for management of Google Places & other Local SEO services – leaving the client free to focus on running their own business.